Is the Narendra Modi government going to abolish the old income tax system…?

In the recently presented full annual budget for the financial year 2024-25 (FY2024-25), giving relief to the taxpayers who choose the new tax regime on the income tax front, Union Finance Minister Nirmala Sitharaman not only increased the standard deduction, but also made the regime more attractive by changing the tax slabs. This year’s budget speech of the Finance Minister has again strengthened the notions that the government may finally end the old tax regime.

Note that although the taxpayers filing Income Tax Return will be able to avail the benefits of the changes made in this year’s budget speech only from next year, the number of people leaving the old tax regime and adopting the new tax regime has increased significantly. After the Finance Minister said in the budget speech that a little more than two-thirds of the taxpayers would adopt the new tax regime, the number of people adopting the new tax regime among those filing ITR for the financial year 2023-24 (FY2023-24) has increased compared to last year.

This time a record number of ITRs were filed

The last date for filing ITR for the financial year 2023-24 (FY2023-24) has passed, and a record number of ITRs have been filed. According to the Finance Ministry data, a total of 7.28 crore taxpayers filed ITR for the financial year 2023-24, i.e. assessment year 2024-25 (AY2024-25) by the last date, i.e. July 31, 2024. This figure is 7.5 percent more than last year, as a total of 6.77 crore taxpayers filed ITR for the financial year 2022-23 (assessment year 2023-24) by July 31, 2023.

72 percent taxpayers adopted the new tax system

According to the Finance Ministry, out of 7.28 crore taxpayers who filed ITR by July 31, 2024 for the financial year 2023-24, i.e. assessment or assessment year 2024-25, 5.27 crore have filed income tax returns under the new tax system, while 2.01 crore ITRs have been filed under the old tax system, so the figure of those who have adopted the new tax system has also increased to 72 percent.

Interesting figures related to ITR filing this year

Meanwhile, two other interesting figures also came to light. The highest number of ITRs, i.e. a total of 69.92 lakh, were filed on July 31, 2024, the last date for filing ITR by salaried taxpayers and taxpayers of all other non-tax audit cases. According to the ministry, the hourly rate of filing ITR was the highest between 7:00 pm and 8:00 pm on July 31, 2024, and 5.07 ITRs were filed in this one hour. The highest rate of filing ITR per second was 917, which was achieved at 8:13:54 am on July 17, 2024. The highest per minute rate of filing ITR was 9,367, which was achieved on the last day, i.e. July 31, 2024 at 8:08 pm. Apart from this, this time the Income Tax Department received a total of 58.57 lakh ITRs from taxpayers who have filed ITR for the first time, which, according to the ministry, is an indication of the expansion of the tax base.

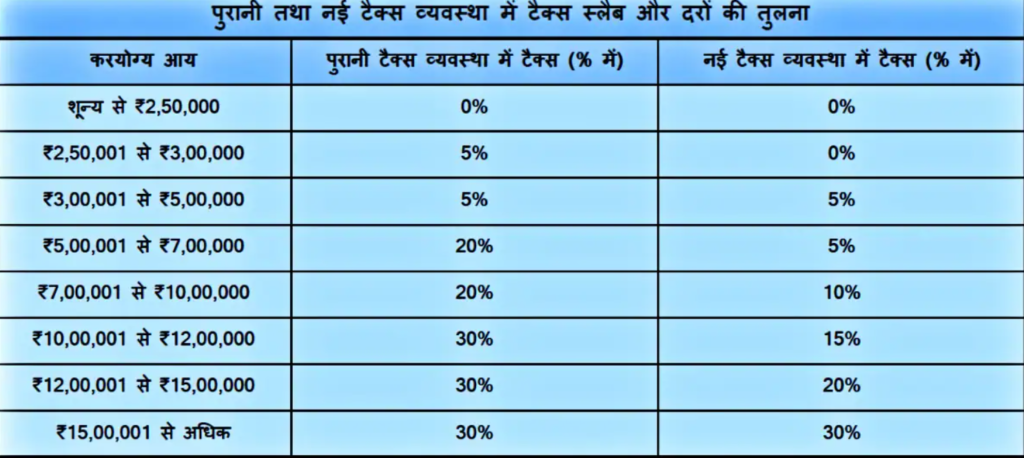

How was the new tax system made attractive…?

Now let us remind you how the new tax regime, i.e. the New Tax Regime, which was first announced in the year 2020, has been made more attractive year after year. In the new tax regime, which was first introduced in the budget for the financial year 2020-21, the tax slabs and rates were kept low. After this, in the general budget presented last year, i.e. in the year 2023, the Union Finance Minister declared the New Tax Regime as the default. Now this year, for those adopting the new tax system, not only has he increased the standard deduction from ₹ 50,000 to ₹ 75,000, but has also made changes in the tax slabs to make it more beneficial. Now the taxpayers adopting the new tax regime will not only have to pay less tax than before, but the process has also become very simple.

“The new tax system is quite simple…”

Income tax experts also say that the new tax system is much simpler than the old tax system. Chartered Accountant Vaibhav Rastogi says, “The new tax system does not cause much difficulty even to those who have never filed ITR before… With the help of simple guidance or the Income Tax Department’s step-by-step guide, the taxpayer can file ITR himself… There is no hassle of calculating the various tax exemptions and deductions available under different sections of the Income Tax Act, so it proves to be very simple…”

According to Vaibhav, in the new tax system, the calculation of the income tax payable by any taxpayer is quite clear, which saves time as well as confusion. In this tax system, the scope for mistakes and negligence is also nominal.

“The government intends to end the old tax system…”

Chartered Accountant Sandeep Goyal, practising in Delhi, says, “Even though those who save a lot and take HRA exemption or exemption on home loan interest are still following the old tax system, the reality is that the number of people adopting the new tax system is constantly increasing, and having two tax systems does increase some confusion…”

Sandeep further said, “On the other hand, the way the government is making the new tax system attractive, it is clear that if not today, then tomorrow, it is going to abolish the old tax system… It is possible that the government may wait for one or two more years before completely abolishing the old tax system, but at some point it will definitely abolish this tax system, so that by having only one tax system, the problems and confusions of the taxpayers can be eliminated…”